Growing Pains

Growing Pains

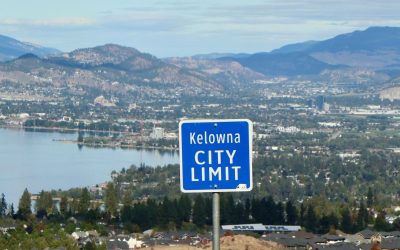

The Kelowna housing market has been the hot topic in Canadian real estate for quite some time now. Between red-hot covid markets to short term rental restrictions and everything in between, our community has seen a lot of change take place in the last few years.

As spring rolled into summer, sales were showing a steady trajectory for housing in Kelowna, but like anything, these changes aren’t without their challenges. The first of these being the limitation of short-term rental properties in BC – something Kelowna has become quite known for as one of Canada’s main tourist attractions.

While the tourism industry seems to be managing this change, there’s been an unsurprising shift in housing availability as property owners transition their short term rental properties into long-term options to make the most of their investments. New construction has also taken a shift in this direction as new rental properties continue to develop at the expense of creating fewer options for buyers in our market.

This is of course the outcome the province had in mind when putting these restrictions in place – creating more long term rental options in our community. The impacts of this change are yet to be determined, but understandably has raised some concerns around the viability of shifting away from housing market investment in favour of rentals.

That being said, the Bank of Canada is on the right path to continue stimulating the housing economy by incentivizing buyers with reduced interest rates. The recent drop from 5% to 4.75% is the first time we’ve seen interest rates drop since Covid. Although this may only appear to be a small step in the right direction, experts speculate interest rates to continue trending downwards – a hopeful outcome that would undoubtedly lower the barrier to entry for Canadians to make long term investments in their local housing markets.

Looking to navigate our ever-evolving market climate? Let’s get in touch to make sure you’re making the best decision for your investment! Together we can navigate these changes with confidence.

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...