Dual Agency Rules Hit Home

Dual Agency Rules Hit Home

Last year, the NDP announced that they would be putting into place new real estate rules that aim to end the practice of dual agency in BC. While the change was meant to be implemented earlier in the year, backlash from the public pushed the start date to the 15th of June this year. But what exactly is dual agency? By itself, it’s the practice of having one agent represent both buyer and seller, however the BCREA estimates that only around 5% of sales in the province are done in this manner, so the chances that you’ve encountered it are quite slim.

While the low percentage may indicate that few people will be affected, in reality the new laws cover much more than just dual agency. Under the legislature, a realtor will have to disclose to their client any relationship that they may have on the other side of the transaction – be it personal or professional. Once they have disclosed the relationship to their client, the responsibility will fall on that realtor’s shoulders to decide whether or not the relationship could be considered a conflict of interest. If they decide that it is, the ultimate decision will be to either walk away from the transaction or risk fines of up to $250,000.

With such tight-knit real estate communities around BC, this change could affect almost every single sale that takes place in the real estate market, however a few markets in particular will be hit the hardest; rural areas, where there are few realtors and very close communities, are especially concerned. For now the changes will be implemented, but there’s reportedly an independent review underway that might affect these new laws down the road.

Make sure to subscribe and stay up to date on all latest news surrounding the new dual agency rules!

Additional Reading

Buyer’s Market Starts 2026

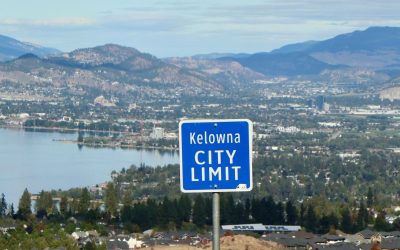

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...