The Road Ahead

The Road Ahead

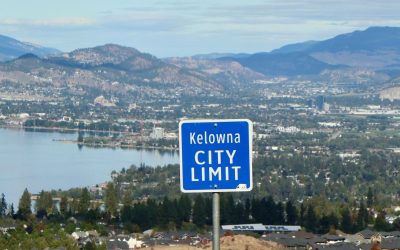

The Okanagan summer is officially here as the sun takes its stand and we say goodbye to a more-than-average rainy June. Now, what can we expect from the Kelowna real estate market as we head into summer?

Earlier this month, the Bank of Canada raised its benchmark interest rate from 4.5% to 4.75% in an effort to curb unsustainable growth in the Canadian real estate market – the highest it’s been since 2001. While it didn’t take long for Canadian banks to unilaterally increase their prime lending rates to 6.95%, there’s now plenty of debate around whether or not this will have the desired effect of slowing inflation, or whether it’ll continue to make matters worse.

In spite of all this, the Okanagan and Interior housing markets continue to show plenty of opportunity (especially for new buyers) as prices decrease and inventory increases. The Canadian Real Estate Association has reported that prices in the Interior were down by 2.2% from six months ago and 9.4% from a year ago. But, like we’ve talked about before, these numbers are all relative to anomalies in the market that we saw throughout the last few years. While it might not sound great at first glance, prices in the Interior are up 44.9% from three years ago and 44.5% from five years ago – the biggest gains in B.C. except for Vancouver Island!

I’ll be the first to admit that it can definitely be a daunting time to know how to go about handling these changing market conditions, but after more than 20 years playing this game, I’m confident I can help you navigate whatever situation you’re in. Get in touch to learn more about the current market conditions and ask any questions you might have about how we can work together to set you up for success 🙂

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...