Protecting the Rent?

Protecting the Rent?

The B.C. government has announced changes to the province’s annual allowable rent increase formula that are expected to save many renters hundreds of dollars next year. Premier John Horgan and Housing Minister Selina Robinson announced Wednesday that they’re accepting the Rental Housing Task Force‘s recommendations and tying rent hikes to inflation alone, a change from the current formula of inflation plus two per cent. So what does this mean for property owners?

Under the new formula, renters paying $1,200 a month – the average rent in the province – are expected to save up to $288 in 2019, according to the government. The previously approved increase would have seen people living in the average two-bedroom apartment in Vancouver paying up to $432 more, the province said. Fortunately, landlords will be able to apply for additional rent hikes if they can demonstrate they’ve been investing in their property.

It’s unclear what kind of rent increases will be allowed under those exceptions, but the province will be doing further consultations to make sure landlords’ needs are met. Even with those exceptions, there have been concerns expressed that the changed formula will make developers less inclined to build rental properties. B.C.’s task force is still completing its report on improving landlord and tenancy laws, expected to be released in November.

Given the constant change taking place in varying areas of the market, it’s important to stay knowledgeable and aware of these policies as can affect property value, rent price, and many other factors! Let’s start talking to help you give a better perspective on what to look for and where to look for it in this evolving marketplace.

Additional Reading

Buyer’s Market Starts 2026

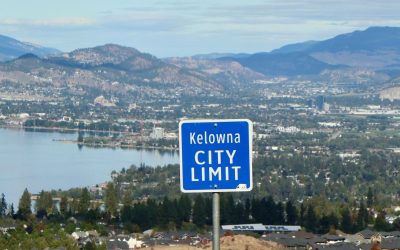

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...