Is The Market Unstable?

Is The Market Unstable?

A few weeks ago the stock market saw its biggest weekly plunge since 2016 with the Dow Jones index falling almost 1,200 points. When stocks and bonds falter it’s only natural to wonder – how does this affect my investments? In a business report for CBC, correspondent Don Pittis took a look at how these changes are expected to affect the housing market, and by extension, you!

So how WILL it affect the housing market? As Pittis points out, home value is remarkably tough to predict, as area trends and other external factors can influence prices. He explains that a better predictor can be the presale market – homes that are bought before being built. Many buyers in this market have seen a severe drop in prices of new homes after they paid a premium. In addition, rising interest rates and the new mortgage stress-test may put off some buyers from taking the plunge.

However, even though the situation might look dire, there are other economic factors that predict a brighter future. Unemployment is low, wages are rising, and Canada is seeing lots of immigration, meaning that even despite the rising interest rates there are likely to be many new buyers and properties entering the market.

No matter what happens, don’t panic! Whether you’re buying or selling, there are ways to make the market trends work for you. A realtor can help you assess the situation and make the most out of whatever the conditions look like, whether that’s taking advantage of a still-favourable market, or knowing when to buy to get the most out of your investment. If you’re feeling the economic uncertainty, make sure to give me a call and together we’ll go over all your options!

Additional Reading

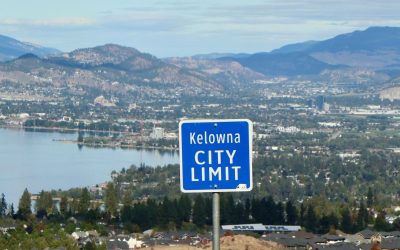

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...