Continued Success

Continued Success

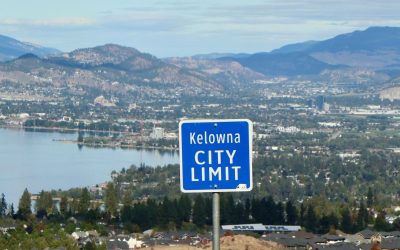

Over the last couple of months there’s been a lot of questions asked about market stability – in British Columbia and the Okanagan alike – with residential sales appearing to dwindle as the Kelowna summer continues to heat up. Then again, when your market’s been as successful as ours for as long as it has (even through COVID times) it’s no wonder that slight changes might create cause for concern.

Despite these understandable speculations, reports are showing that things are right on track with the market’s historical averages for this time of year. In fact, residential property sales are up 10.7% over the same month a year ago and available listings are up 13.8% compared to a year ago; two great indicators of a healthy housing market. As much as the latest mortgage rate increases imposed by the Bank of Canada (and Canadian banks adjusting their prime lending rates in kind) might have a deterring impact on new market activity, these year-over-year increases are showing a strong trajectory for the rest of 2023. And so far, the changes in mortgage rates aren’t having the intense effect that some thought they would – more good news!

The biggest overall win in the current state of the market is the availability of inventory, especially considering last year’s inventory was very sparse, creating a bundle of difficult circumstances. According to the Association of Interior Realtors vice-president Lyndi Cruikshank, “There’s definitely less people looking for homes right now and there are more homes on the market so it’s what I would call a more balanced market which is really nice to see.”

Looking for guidance navigating our ever-evolving Okanagan real estate market? Let’s chat!

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...