BC Housing Expected To Cool In 2019

BC Housing Expected To Cool In 2019

Reports from market watchers claim that 2019 could be one of the more affordable years to buy a condo in B.C., thanks to the increased supply and regulatory measures that have contributed to suppressing home sales.

The Real Estate Board of Greater Vancouver reported a nearly 43 per cent decrease in condo sales, townhouses, and detached homes in October, compared to sales in November of 2017. Some economists claim that the driving force behind the downward turn is due to more stringent mortgage qualifying requirements, and higher interest rates.

Homeowners can expect to see increases of five to fifteen per cent for assessed values of single-family homes. The valuation assessments are already underway, but the B.C. Assessment has already said that the softening market has lowered some valuations in Metro Vancouver.

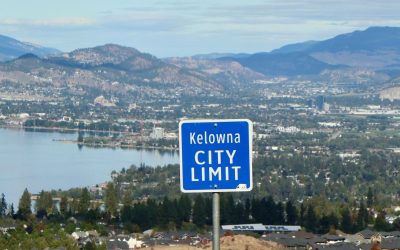

Contact me to learn more about what to expect from Kelowna’s condo market this year, and start searching for your new home today!

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...