Bank of Canada Raises Interest Rate to 1.75%

Bank of Canada Raises Interest Rate to 1.75%

The Bank of Canada can finally see “home” on the horizon with the latest increase of interest rates now levelling out. Governor Stephen Poloz and his deputies on the Governing Council raised the benchmark interest rate a quarter point to 1.75 percent, as expected.

They said they feel pretty good about the economy now that politicians in Canada, Mexico, and the United States have agreed on a revised trade agreement and that evidence suggests households are adjusting well to higher borrowing costs. Policy makers raised their outlook for business investment and exports, suggesting the economy is becoming less reliant on debt-fuelled spending and the housing market.

Senior deputy governor Carolyn Wilkins’s emphasis on the still-low level of borrowing costs was a reminder that the public needn’t panic at the sight of marginally higher interest rates, and a gentle warning that no one should expect interest rates to stay at this level.

The economy is growing a little faster than the Bank of Canada predicted a few months ago, and “vulnerabilities” from elevated levels of household debt are “edging lower,” it said. Policy makers reiterated that interest rates must rise, and for the first time offered a more definitive notion of where it wants to go.

So – what does this mean for you? As a long-standing real estate agent, it’s my job to put your minds at ease, and not let financial disturbances come between you and your dream home! Let’s talk today, and you’ll see just how painless navigating mortgage rate fluctuations really are!

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

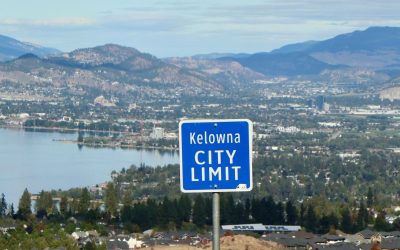

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...