To Flip or Not to Flip

To Flip or Not to Flip

The BC real estate market is about to see another major change coming in January 2025. A newly proposed tax presented by the provincial government in their yearly budget – commonly referred to as ‘The Flipping Tax’ – aims to decentivize short term purchase investments by applying a 20% tax for properties bought and sold within a one year time frame, and scaling down to 0% after two years.

While this may sound insignificant to some, new measures like this may potentially impact real estate investment in British Columbia. Coupled with the restrictions on short term rentals that have the whole town talking and will take place effective May 1st, BC’s real estate market is unquestionably going through a very unique time.

Fundamentally, these new policies are looking to discourage short term market activity in attempts to create more sustainable long-term housing potions for BC residents. However, the short term impacts are going to take some time to find their footing. With the short-term rental restrictions about to take hold, experts are predicting an influx of available listings as owners begin to offload their short-term rental properties.

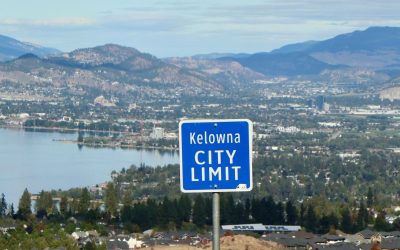

However, the Kelowna City Council are finding new creative ways to maximize the market potential of our rapidly growing city. Their proposal aims to increase the number of units allowed per lot by introducing new bylaws that will create the potential for rezoning up to 26,000 lots in Kelowna.

With so many changes happening to our local market, it’s never been a better time to get informed to make sure your investment goals align with these new policies. If you’re ever curious or have questions, please contact me to get the conversation started! It would be my pleasure to help point you in the right direction 🙂

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...