Living in the Fast Lane

Living in the Fast Lane

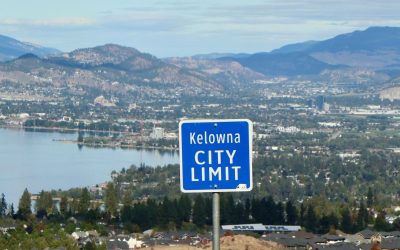

The Okanagan market continues to flourish with inventory at an all-time low and buying interest continuing to rise, specifically from larger urban centres. Now with the weather getting nicer, we’re also seeing a shift in focus from residential properties to recreational properties, while even blurring the line between the two. In a city like Kelowna, you could argue that nearly any property is a vacation property! No wonder we’re the fastest growing city in Canada..

For the time being we can expect this red hot buyer’s market to continue until inventory starts to replenish. With plenty of new developments going up across the city over the near future it’s tough to say when this might be, but one can assume to see the volume of inventory increase with so many new apartments being built – like the new ‘Water Street by the Park’ development consisting of three towers at 24, 26 and 42 storeys.

If you’re considering relocating to Kelowna or are looking to sell, let’s get in touch and start making a plan. Before you know it we might see some double-digit price increases this spring, so let’s make the most of it!

Additional Reading

Buyer’s Market Starts 2026

The New year is starting off with a strong stride for buyers looking to get into the Kelowna real estate market. The start of 2026 is leaning this way thanks to a harmony of factors - namely healthy inventory levels and low interest rates - which have tiled the scales...

Eyes on the Rise

As we head into 2026, Kelowna’s real estate market is showing some profoundly positive indicators. With many new developments being recently completed or nearing the finish line, the City of Kelowna’s plans to continue our community’s infrastructure improvements, and...

A New Kelowna Emerges

Once upon a time, Kelowna was a tranquil community known for its beautiful weather, thriving tourism, retirement destination appeal, and reputation as a wonderful place to raise a family. Fast-forward to 2025 and all of that still holds true, only now our town has...